How to trade in Stocks Trading

When you start trading stocks, make sure you take these important steps:

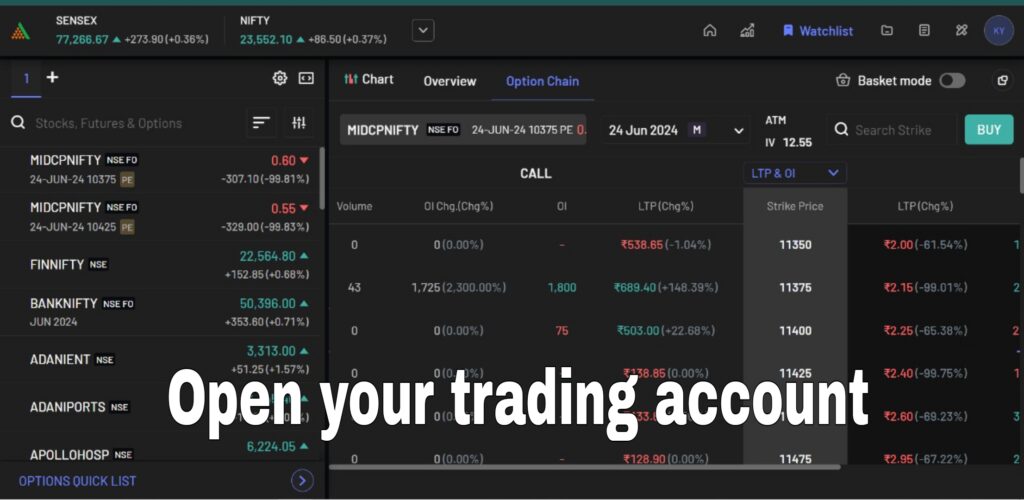

Setup a Brokerage Account: To purchase and sell stocks, you must create a brokerage account. Choose a reliable brokerage from the many options available that best suit your requirements and tastes.

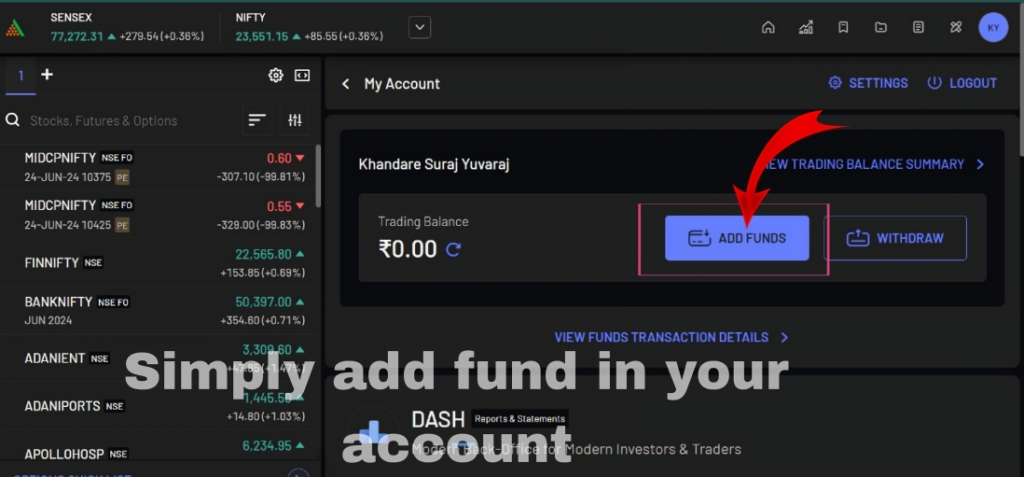

Fund Your Account: Once your brokerage account has been created, add money to it by making the necessary number of deposits. You can either write a check or transfer money from your bank account to accomplish this.

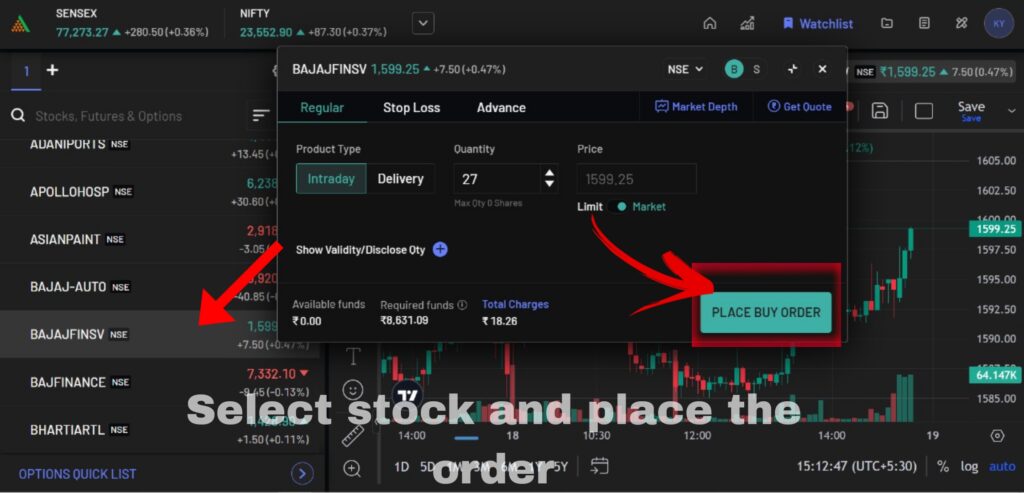

Place Stock Orders: You are able to start trading stocks as soon as your account has been funded. Orders can be placed using a number of channels, such as the broker’s mobile app, phone calls, and online platforms.

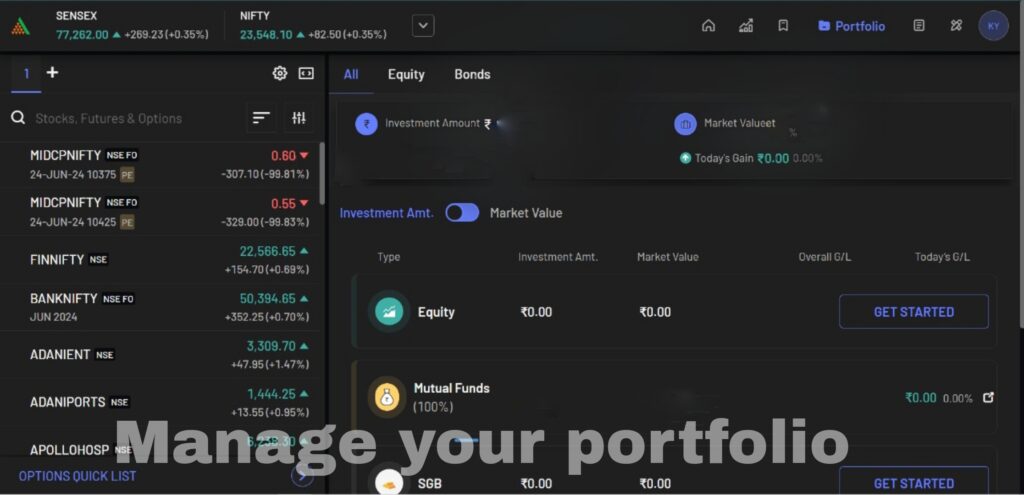

Maintain Your Portfolio: After buying stocks, keep a close eye on your portfolio. To maximize your investing approach, monitor stock prices and make adjustments as needed.

Types of Stock Orders: Two primary types of stock orders are commonly used:

Market orders: Market orders are those that are swiftly executed to purchase or sell stock at the going rate in the market.

Limit orders: Limit orders let you purchase or sell stocks at a specific price, or at a better one. They might not happen right away, but at least you get to set the price.

How to Trade in Stocks Using Technical and Fundamental Analysis

In the world of stock trading, two essential analytical approaches are Technical Analysis and Fundamental Analysis

Technical Analysis: This involves studying historical price charts and patterns to identify trading signals.

Imagine a huge mood swing chart in the stock market. Technical analysis examines these mood fluctuations and attempts to predict the market’s future actions by analyzing historical prices and trading volume. In order to identify patterns and trends that may indicate future price changes, analysts utilize complex charts and lines.

Consider it this way: A stock price that has been growing gradually for some time may be a hint that it will continue to rise. Alternatively, a quick surge in the volume of purchases of a specific stock may signal a buying frenzy and an impending price increase.

Advantages:

Simple to understand

helpful for trading in the short term (such as identifying brief trends)

Cons:

Not always accurate.

depends on historical data, which may not ensure the future.

Fundamental Analysis: It entails assessing a company’s financial performance and other factors to determine its intrinsic value.

This method is more like reviewing the report card of a business. To determine if a company is an ideal investment, analysts examine its financial statements, earnings, and the general situation of the economy. They want to know how profitable the business is, if it has debt, and whether the economy is strong enough for it to prosper.

Consider purchasing stock in a business that has recently introduced a very amazing new product. If more individuals desire to invest, their stock price may rise!

Advantages:

Assists in locating cheap stocks with long-term prospects.

focuses on the true worth of an organization.

Cons:

May not be useful for short-term trading.

requires more time and effort to investigate.

Both methods can be used to make informed trading decisions. However, it’s vital to understand that no analysis method is foolproof, and there are no guarantees of profitable outcomes in every trade.

Using effective risk management techniques is essential to stock trading. The following are important things to remember:

Stop-Loss Orders: Use stop-loss orders to have a stock automatically sold if its price drops below a certain threshold. This helps reduce possible losses in times of market downturns.

Diversification: Invest in a number of various stocks to diversify your portfolio. This reduces the danger of a single stock doing poorly.

In Conclusion:

Profitable investing prospects are presented by stock trading, but before getting started, it’s important to understand the hazards involved and do an extensive study. Make sure you follow strict risk management guidelines and have a well defined trading plan.

How To Trade In Stocks: Additional Tips for Successful Stock Trading

Start Small: To start trading stocks, you don’t need a large amount of money. It can even be as low as $100.

Invest for the Long Term: Although stock market swings are sometimes brief, historical patterns point to long-term gain. To lower risk, think about taking a long-term investing approach.

Avoid overtrading: Refrain from making too many transactions in a short period of time. Trading too much might result in losses.

Regularly Realize Profits: To protect against future market reversals, consistently realize profits, no matter how little.

Sensible Risk Management: Never take on more debt than you can comfortably lose in a single transaction.

Remember that trading carries inherent risks; prior research and risk comprehension are paramount before embarking on your trading journey.

Useful information ☺️

thanks for your words…